Everyone wants to improve their financial position - it is one of out most basic desires. However, an action plan without definitive strategies, will never change anything. Planning allows you to make sound financial decisions, while understanding how they will impact on other areas in your life.

With KPS Wealth, we help you create a sustainable and realistic financial plan that you feel comfortable with, rather than being told where to invest. During our process, we get to know you personally, learn about your career or business aspirations, understand your existing financial affairs, the importance of your family and what you want to achieve for your future security.

Receiving financial advice should not be a one off event. By tailoring a plan specifically for you, we continually monitor and assess its

strengths and weaknesses over time, making adjustments to optimise your plan, along the way.

To start you on your personalised financial plan, Contact Us today. Financial planning is for the long term, and so are we.

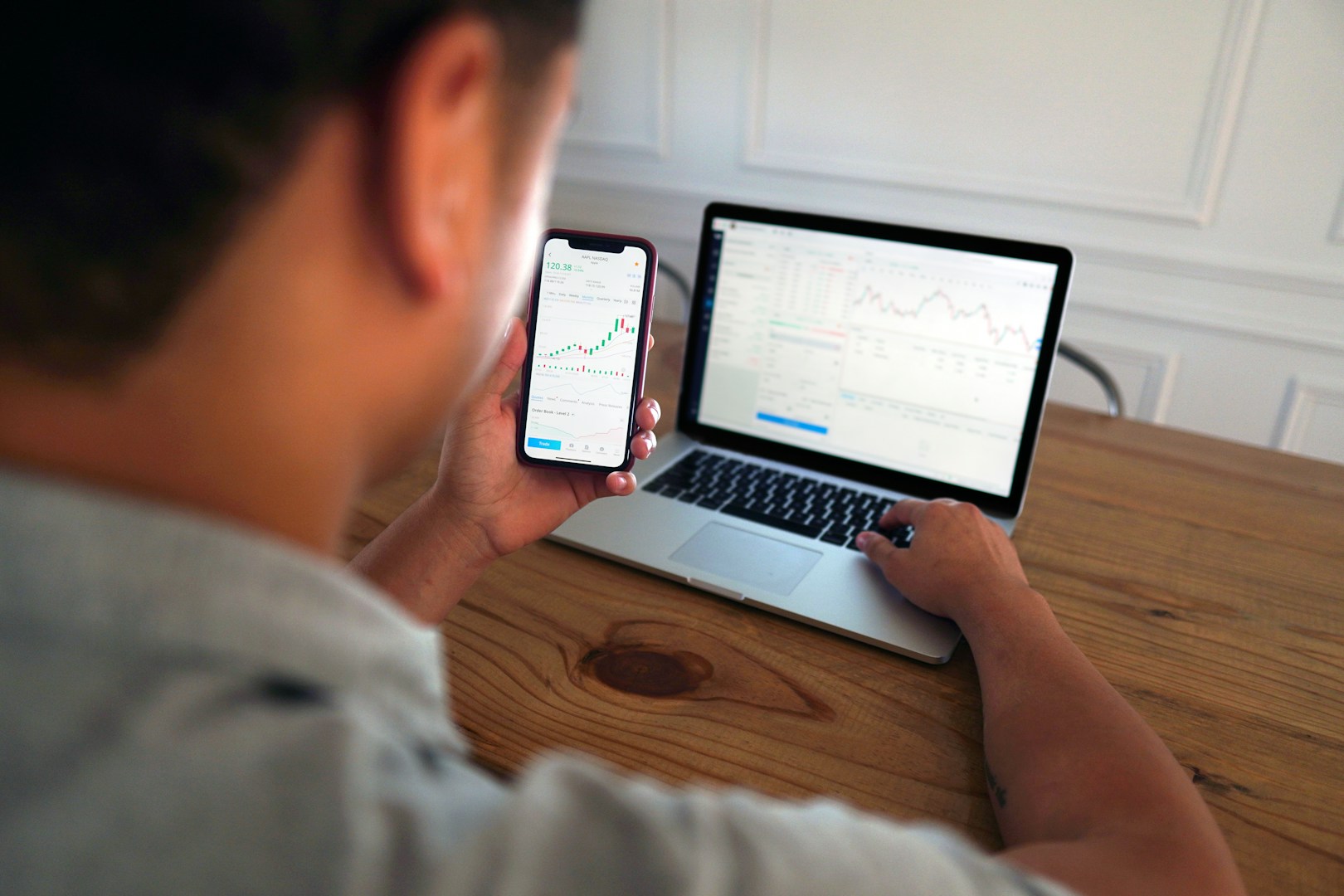

Have you ever wondered how the stock market works, or how people create wealth from buying and selling shares. If you have never bought or sold shares, and considering this form of wealth creation, it can be overwhelming and tricky. Sometimes even risky.

When someone owns a share, they own part of that company which means they have interest in how the company performs. If the company performs well, then the share price will increase, and they are entitled to a portion of those profits in the form of a dividend. The shares can be sold at a profit and the process is repeated.

This method of making money works well when someone is guiding and researching the investment decision. There are many factors that affect a share price, such as supply and demand, which is why it's important to have sound knowledge and understanding of what is involved with share trading.

When done right, there are a number of benefits to share trading, the two most important being:

At KPS Wealth, our experienced advisors are on hand to help you increase your wealth by building a tailored direct share portfolio for you.

We buy and sell shares at competitive brokerage rates. Given the market’s tendency to fluctuate, all of our advisors build on their

knowledge base by using research from respected research providers.

To start you on your personalised financial plan, Contact Us today. Financial planning is for the long term, and so are we.

Investing in managed funds is a fantastic way to stretch a small sum of money over a wide range of stocks with diversification, a critical cornerstone to any investment strategy.

Managed funds can be a good investment because they:

We understand that you are working hard for your money and would like your money to work harder than you.

By remaining objective, critical and not being restricted to recommending in-house products, our skilled advisors can identify funds that

are most benefit and truly suit you. There are currently over 2,000 managed funds available, covering every possible combination and

variation of investing styles. Finding the perfect fund for you takes time, effort and inside knowledge. That’s how KPS Wealth can help

you.

To start you on your personalised financial plan, Contact Us today. Financial planning is for the long term, and so are we.

Taking a tactical approach to wealth creation, gearing or borrowing may give you access to investments that have been beyond your

reach.

By borrowing to invest and adding to your existing funds you create:

Gearing offers large wealth creation potential, however it can be a complex process. Understanding the risk factors with gearing, we

consider all the factors to mitigate risk to you. Whether it is home equity loans, or margin lending, we seek to find the right

product to suit your situation.

To start you on your personalised financial plan, Contact Us today. Financial planning is for the long term, and so are we.